Top of page.

- Skip the menu to main contents.

Link for header starts here.

![]()

Page ends here.

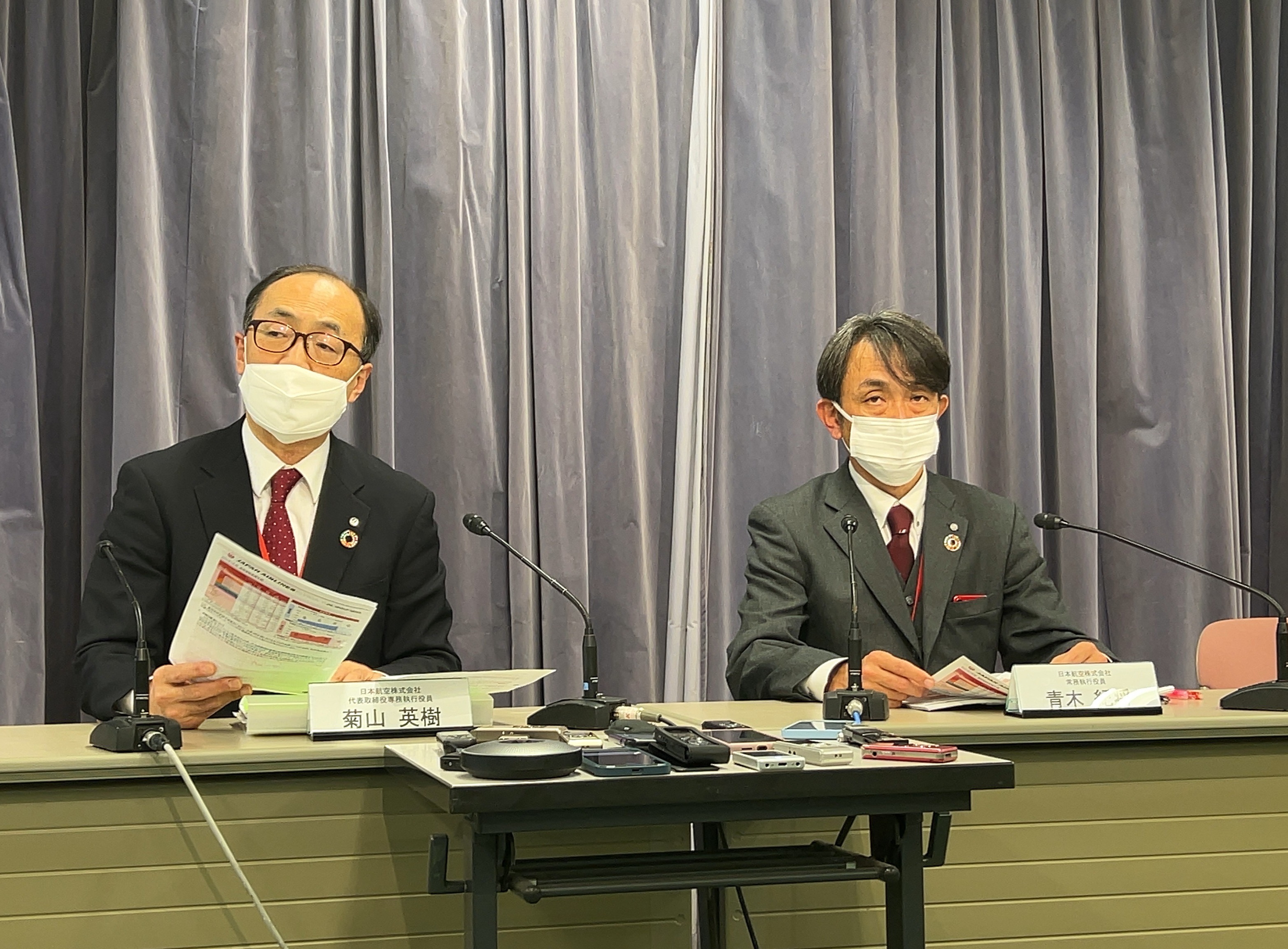

Financial Results Announcement (February 2, 2023)

JAL announced the financial results for the third quarter of the fiscal year ending March 31, 2023.

Here is a summary of the press conference.

I would like to explain the financial results for the third quarter of the fiscal year ending March 31, 2023.

First, I will explain our consolidated results in general.

In the third quarter, revenue increased by 507.1 billion yen year on year to 1 trillion 5.5 billion yen, driven by the recovery in international passenger demand following Japan's reopening of borders in October and the recovery in domestic passenger demand due to the behavioral change of passengers. Despite higher jet fuel prices and the weak yen, operating expense increased by only 302.1 billion yen year on year through efficient cost management of non-fuel costs. As a result, we achieved 34.7 billion yen in EBIT and 16.3 billion yen in net profit, the first profit since the outbreak of COVID-19.

In the third quarter alone, we reported EBIT of 34.4 billion yen and a net profit of 18.4 billion yen, showing that we are on track to business recovery.

Now I will explain the results in each business area.

First, in the full service carrier business area, international passenger revenue increased approximately six fold year on year to 287.1 billion yen. In addition to the lifting of Japan's cap on daily arrivals from mid-October, passenger traffic to and from Japan recovered substantially as various restrictions were lifted, such as the short stay visa waiver program for tourism. Passenger traffic recovered steadily from fiscal 2019 levels: 30% in Q1, 40% in Q2 and 51% in Q3.

Domestic passenger revenue increased approximately two fold year on year to 335.5 billion yen. Strong recovery was observed centered on tourism demand, reaching 90% during the year-end and New Year period due to new travel behavioral patterns and the removal of restrictions on free movement. Passenger traffic recovered steadily from fiscal 2019 levels: 66% in Q1, 75% in Q2 and 89% in Q3.

Cargo and mail revenue ended at 183.4 billion yen. In international cargo operations, cargo weight trended downward from the previous year partly due to the easing of shipping congestion. However, we were able to maintain relatively high air freight rates, which led to revenue growth.

Revenue in the LCC business area totaled 20.1 billion yen. ZIPAIR increased its presence through the successful launch of its San Jose route in December, amongst others, and recorded a large increase in passenger traffic. On the other hand, the challenging business environments on China routes and Japan domestic routes continued to aggravate the business results of SPRING JAPAN and Jetstar Japan.

The Mileage, Lifestyle and Infrastructure business area posted 167.7 billion yen in revenue, with the mileage business maintaining stable profits. This business area is growing steadily to become the second largest after air transportation.

We will steadily implement business restructuring as outlined in our Medium Term Management Plan.

Moving on to expense, we are keeping costs under control. Although fuel costs increased sharply by 139.8 billion yen year on year due to soaring jet fuel prices and the weak yen, non-fuel costs increased by only 27% in contrast to the 60% year on year increase in overall ASK (available seat km). Actual fixed cost ended at 367.1 billion yen. We will continue to work to further keep expense below the 500 billion yen yearly target as we promised in our Medium Term Management Plan.

Next, I will briefly explain our ESG strategy. In November 2022, we operated "Sustainable Charter Flight" with net zero CO2 emissions on the Tokyo (Haneda)=Okinawa (Naha) route. In December 2020, JAL was selected for the first time as a constituent of the Dow Jones Sustainability Asia Pacific Index, a prominent ESG investment index, and received an "A-"climate change rating from CDP, an international environmental non-profit organization.

Next, I will explain our consolidated financial position and cash flows as of the end of the third quarter.

As for our consolidated financial position, the equity ratio based on credit ratings is 39.5% and the net debit equity ratio is 0.2 times, which show that we are financially sound. We have sufficient liquidity as of the end of December, with cash and cash equivalents of 553 billion yen and an unused commitment line of 250 billion yen.

As for cash flows, EBITDA was 156.1 billion yen and operating cash flow improved significantly by 278.1 billion yen year on year, partly attributable to an increase in advances received resulting from the recovery in passenger demand, which brought in a cash inflow of 191.4 billion yen. We also have a positive free cash flow of 117.3 billion yen.

Next, I will explain revisions to our full-year earnings forecast for fiscal 2022.

Based on the latest domestic and international passenger and cargo demand forecasts, we have revised down our full-year consolidated earnings forecasts for the fiscal year ending March 2023 (fiscal 2022). The new forecast for fiscal 2022 is 1 trillion 358 billion yen in revenue, 50 billion yen in EBIT and 25 billion yen in net profit. Specifically, revenue was revised down 46 billion yen, EBIT, down 30 billion yen, and net profit, down 20 billion yen.

We regret to inform you of this major downward revision to our full-year financial forecast.

While international passenger revenue is expected to exceed our forecast by 3 billion yen through higher unit revenue, domestic passenger revenue is seen to fall short of our initial forecast due to the slower-than-expected recovery of business demand, a reluctance to spend as people wait for the nationwide travel support program to resume, and the eighth wave of infections. Furthermore, cargo and mail revenue is also seen to fall short of our initial forecast by 11 billion yen, as air freight rates are not reaching expected levels due to the easing of the supply-demand balance.

On the other hand, operating expense is seen to decline by 16 billion yen. While fuel costs ended as forecasted, we steadily reduced non-fuel costs, but not enough to cover the decline in revenue.

As a result of the above, both EBIT and net profit have been revised downward. We will make every effort in the remaining two months of fiscal 2022 to increase revenue and make as much profit as possible under robust cost management, such as simulating domestic tourism demand.

Finally, I would like to explain about dividends.

As I have explained so far, we will do our best to resume payment of year-end dividends. Although air travel demand is still recovering and uncertainty remains, we are on track to achieving profitability this fiscal year with bright prospects for the future to a certain extent. Therefore, we have announced today a year-end dividend forecast of 20 yen per share. From next fiscal year, we will focus on dividend continuity and stability and a payout ratio of at least 35% on achieving sufficient profit.

Finally, I would like to thank once again all parties concerned for supporting the aviation industry by way of the nationwide travel support program, the reduction of taxes and public charges, and subsidies to curtail rising fuel costs. We will do our best to provide unparalleled service to our customers with gratitude for their continued support, move ahead with business restructuring as set forth in our Medium Term Management Plan, and make concerted efforts to live up to everyone's expectations.