Corporate Governance

-

Corporate Governance Report [9.79 MB : PDF]PDF

-

Fundamental Policies of Corporate Governance[182 KB : PDF]PDF

Fundamental Policies

We maintain an awareness that our corporate group is a member of society at large with the duty to fulfill our corporate social responsibility and contribute to society as we develop our business, in addition to fulfilling our financial responsibility of earning adequate profits by providing high quality products through fair competition while maintaining flight safety as the leading company of safety in the transport sector and providing the finest service to our customers.

Taking this into account, we have established JAL Philosophy in accordance with the JAL Group Corporate Policy, "JAL Group will pursue the material and intellectual growth of all our employees, deliver unparalleled service to our customers, and increase corporate value and contribute to the betterment of society." We will strive to enhance corporate value and achieve accountability by establishing a corporate governance system that results in high management transparency and strong management monitoring, while at the same time engaging in speedy and appropriate management decision making.

The Board of Directors has established corporate governance by adopting the Fundamental Policies of Corporate Governance as a key set of rules subsequent to the Companies Act, relevant laws and regulations and the Articles of Incorporation, and reviews it at least once a year.

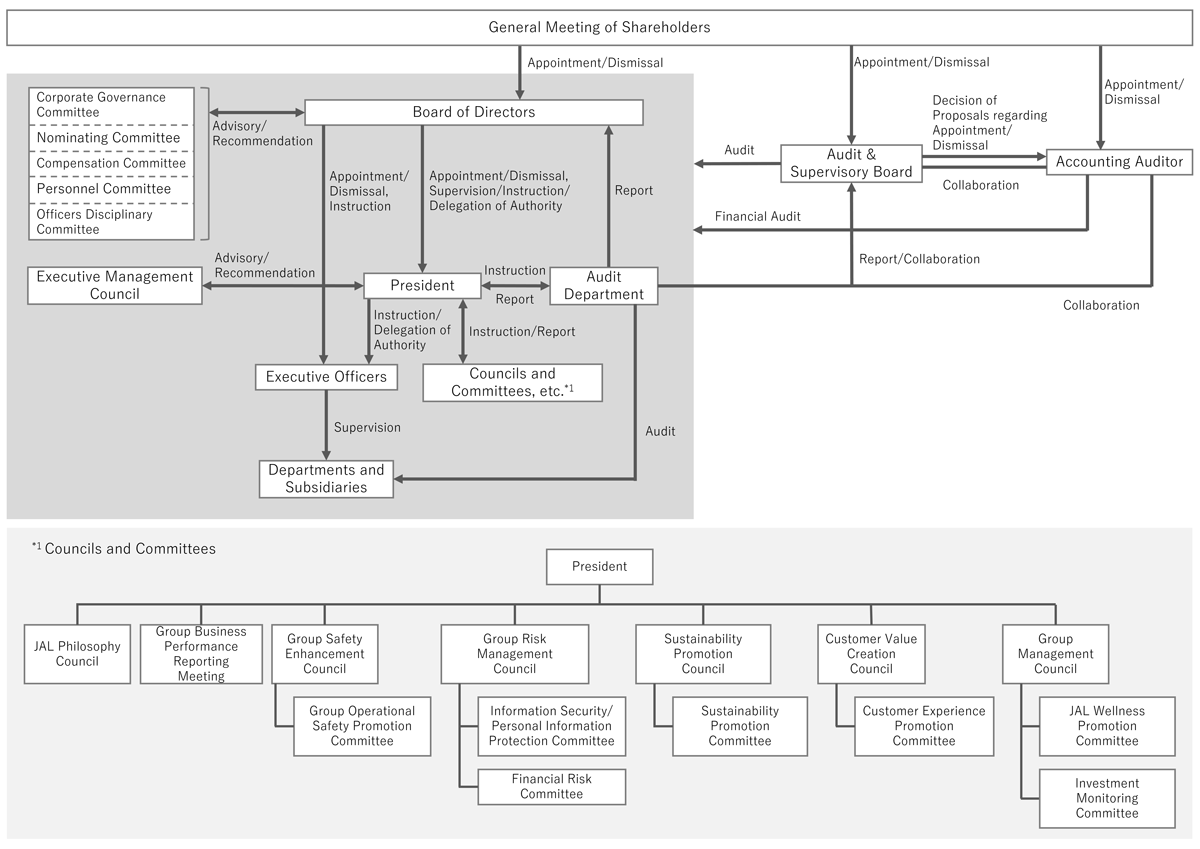

Corporate Governance System

1.Corporate Governance System(Fig.)

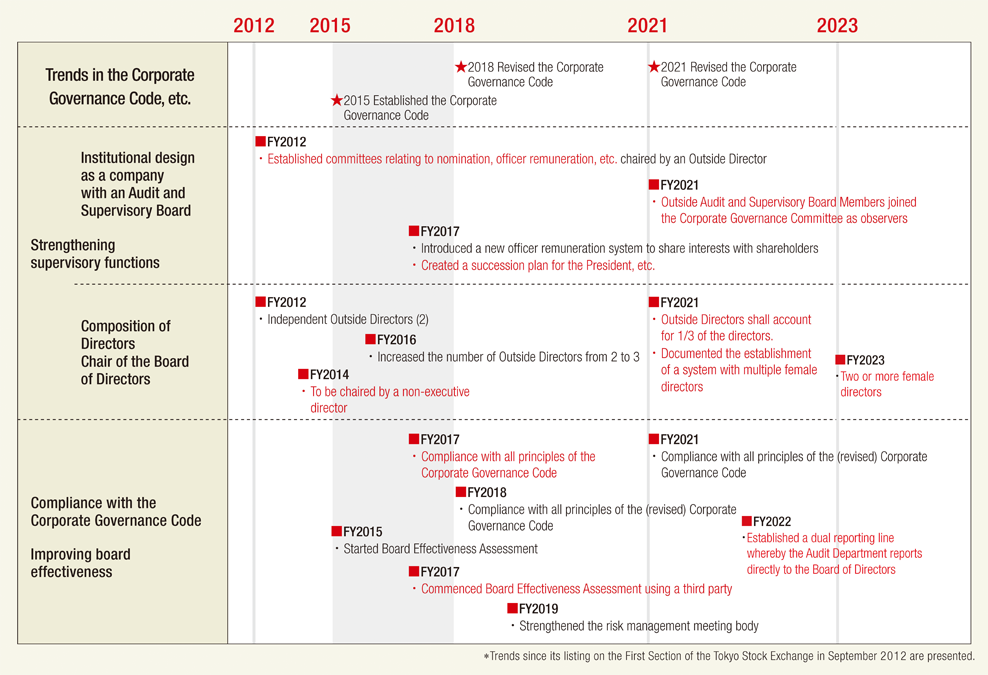

Evolution of Improvement of JAL’s Corporate Governance System

2.Board of Directors and Directors

(1)Board of Directors

The Board of Directors exercises strong management monitoring with a high degree of transparency through the nomination of Directors, Audit and Supervisory Board Members and Executive Officers, decision of officer remuneration, and important decision-making.

To fulfill this role,

①The Board separates the management monitoring and business execution functions. The Board Chair is nominated from among Directors who do not concurrently serve as Outside Officer.

②At least three highly independent candidates are nominated for Outside Director, and from the Ordinary General Meeting of Shareholders in June 2021, Outside Directors account for at least one-third of all Board members.

③ In Fiscal 2021, we decided to increase female Director appointments.

④From fiscal 2021, Directors and Audit and Supervisory Board Members are required to basically attend at least 80% of all Board meetings.

⑤The Board delegates appropriate authority to the President to ensure efficient decision-making.

<In FY2025>

Chairperson : Yuji Akasaka(Director, Chairperson)

Members: AKASAKA Yuji, TOTTORI Mitsuko, SAITO Yuji, AOKI Noriyuki,

KASHIWAGI Yoriyuki, NAKAGAWA Yukio, YANAGI Hiroyuki, MITSUYA Yuko and KOMODA Masanobu

<In FY2024>

Chairperson : Yuji Akasaka(Representative Director, Chairperson)

Members : AKASAKA Yuji, TOTTORI Mitsuko, SAITO Yuji, AOKI Noriyuki,KASHIWAGI Yoriyuki, TAMURA Ryo, KOBAYASHI Eizo, YANAGI Hiroyuki, and MITSUYA Yuko

Number of meetings:17 meetings (Directors and Audit and Supervisory Board Members attended all 17 meetings. Directors AOKI, KASHIWAGI, TAMURA and Audit and Supervisory Board Member MATSUMURA, who have been in office since June 2024, atttended all of the 14 meetings.)

Number of meetings:17 meetings (Directors and Audit and Supervisory Board Members attended all 17 meetings. Directors AOKI, TAMURA, KASHIWAGI and Audit and Supervisory Board Member MATSUMURA, who have been in office since June 2024, attended all of the 14 meetings. Directors UEKI,SHIMIZU,TSUTSUMI and Supervisory Board Member KAMO, who have retired in June 2024, attended all of the 3 meetings.)

Main Agenda Items Discussed by the Board of Directors

〔Management Strategy〕

- FY2021-2025 JAL Group Medium Term Management Plan Progress of Rolling Plan 2024

- - Initiatives related to sustainability

- - Progress in structural business reforms

- - Promoting human resources strategies

- - Promoting DX strategies

- Formulating the JAL Group Medium Term Management Plan Rolling Plan 2025 for FY2021 to FY2025

〔Decision and Oversight of Other Important Business Executions〕

- Selection of small aircraft

- Investment in aircraft cabins

- Maintenance core system renewal

- System renewal related to the loyalty program

〔Financial Results and Finance〕

- Each quarter financial results

- Financing

- Shareholder return

〔Governance and Risk Management〕

- Report on safety

- Board Effectiveness Assessment

- Revision of the Regulations of the Board of Directors

- Verification of policy shareholdings

- Recognition and policy on listed affiliates

- Committee reports and decisions on the appointment of new executives and their remuneration

- Development and evaluation of internal control

- Risk management related reports

- Measures towards the audit report submitted by the Audit and Supervisory Board Members

- Audit and Supervisory Board Member audit policies and results

- Policies of the Audit and Supervisory Board Members and their audit results

- Report on aircraft accidents

- Report on Administrative Guidances

〔Dialogue with Stakeholders〕

- Approval of shareholder meetings and shareholder return-related proposals

- Operational status of shareholder benefit programs

- Feedback regarding IR orientation meeting

- Disclosure of information on Climate Change Based on TCFD

(2)Directors

〔Board diversity〕

①Directors are selected from those with extensive experience in various fields and high insight and expertise, paying attention to ensuring diversity in terms of gender, international nature, work history, and age, among others. In addition, we have also been promoting DEI in the management level. In 2023, we had multiple female Directors, and in 2024, we have appointed female to our President for the first time in our history.

②The skills matrix for expertise and experience that directors should possess was developed in FY2021, and revised in FY2023, before being made public.

〔Outside Directors〕

①Outside Directors shall provide advice on the Company's management from a practical and multifaceted perspective and appropriately supervise the execution of business operations.

②Outside Directors are appointed from persons with vast knowledge and experience in various fields in order to ensure diversity. Those who do not qualify as highly independent within the meaning of our “Standards for Independence of Outside Directors” will not be appointed. In addition, we will not appoint any person as a candidate for Outside Director who concurrently serves as a Director, Audit and Supervisory Board Member, etc. for more than four other listed companies.

③One Outside Director shall be appointed as Lead Independent Outside Director to improve coordination with Audit and Supervisory Board Members and internal divisions.

〔Independent External Directors and Ratio of Female Directors (as of June 24, 2025)〕

- Ratio of Independent External Directors:33.3%(3 out of 9 Directors are External Directors)

- Ratio of female directors:22.2%(2 out of 9 Directors is a female director)

〔Average Term of Office of Audit & Supervisory Board Members (as of June 24, 2025)〕

- 2 years and 2 months

3.Optional Committees

We have established various committees under the Board of Directors in order to build a corporate governance system that demonstrates high management transparency and strong management oversight. A majority of the committee members are Outside Directors, ensuring independence from management.

(1)Corporate Governance Committee

To make necessary reports and recommendations to the Board of Directors to strengthen corporate governance for the company's sustainable growth and enhancement of corporate value over the medium to long term.

The Corporate Governance Committee is comprised of the Board Chair and Outside Directors and is chaired by the Lead Independent Outside Director.

<In FY2025>

Chairperson: YANAGI Hiroyuki(Lead Independent Outside Director)

Board Member:AKASAKA Yuji, MITSUYA Yuko, KOMODA Masanobu

Observer : OKADA Joji (Independent Audit & Supervisory Board Member)

<In FY2024>

Chairperson: KOBAYASHI Eizo(Lead Independent Outside Director)

Board Member:AKASAKA Yuji, YANAGI Hiroyuki, MITSUYA Yuko

Observer : OKADA Joji (Independent Audit & Supervisory Board Member)Number of meetings:3 meetings attended by all the members

Main activities:Made recommendations such as the delegation of authority to the Executive Committee for the expansion of strategic discussions at the Board of Directors meetings. In the Board Effectiveness Assessment, recommendations were made regarding the assessment for FY2024 and key issues for FY2025.

(2)Nominating Committee

When submitting a proposal to the General Meeting of Shareholders concerning the appointment of candidates to the positions of Director and Corporate Auditor, the Nominating Committee will make comprehensive judgment of the personality, knowledge, ability, experience and performance, and the like, of the candidate based on an inquiry from the Board of Directors and will report back to the Board.

The Nominating Committee has also determined that the qualities required of the President, and other directors. are "those who, by bearing in mind that flight safety is the foundation of the JAL Group's existence and by taking the lead in putting the JAL Philosophy into practice, can work with all employees to achieve steady results toward the realization of the Corporate Policy". In addition, the JAL Group will provide candidates for the position of president, and other directors. with practical and diverse experiences so that they can acquire the necessary management skills at an early stage.

If the business conduct of any member of top management is found questionable due to legal violations, harassment, negligence of the Board, to name a few, the Nominating Committee and/or Directors, excluding the person in question, will immediately investigate the situation based on a motion made by a Director at a Board meeting or other meetings, and the like, the Nominating Committee and/or Directors excluding the person in question will immediately investigate the situation based on a motion made by a Director at a Board meeting or other meetings. The Nominating Committee and/or Directors will report findings to the Board, which will then decide on an appropriate disciplinary penalty.

The Nominating Committee is comprised of the President and no more than four Directors elected by a resolution by the Board of Directors, and the majority of members shall be External Directors. The Chair shall be selected from among the Outside Directors by mutual vote of the committee members.

<In FY2025>

Chairperson: YANAGI Hiroyuki(Lead Independent Outside Director)

Board Member: TOTTORI mitsuko, SAITO Yuji, MITSUYA Yuko, KOMODA Masanobu

<In FY2024>

Chairperson: YANAGI Hiroyuki

Board Member: TOTTORI mitsuko, SAITO Yuji, KOBAYASHI Eizo, MITSUYA Yuko

Number of meetings:9 meetings attended by all the members

Main activities:In addition to matters to be reported to the Board of Directors, the Committee discussed requirements and processes related to the election of candidates for Executive Officers, the process for reappointing the President, and the future succession plan for management personnel. Regarding the confirmation of the reappointment of the President, outside directors and the President engaged in dialogue and concluded that Ms. TOTTORI Mitsuko's reappointment as President in FY2025 is desirable for the Group's management, given that while maintaining team management, she contributed to enhance corporate value as well as endeavored to reform the Group by encouraging autonomy and independence among executive officers.

(3)Compensation Committee

The Compensation Committee discusses matters concerning the amount of compensation for Directors, Executive Officers and Corporate Auditors based on an inquiry from the Board of Directors and reports back to the Board. In addition, the committee reviews the remuneration system as appropriate to ensure that it provides sound incentives for sustainable growth.

The Compensation Committee is comprised of the President and no more than four Directors elected by a resolution by the Board, the majority of members being Outside Directors. The chair shall be selected from among the External Directors by mutual vote of the committee members. As a result, transparency and fairness in the compensation determining process is secured.

<In FY2025>

Chairperson: KOMODA Masanobu(Outside Director)

Board Member ,TOTTORI Mitsuko, SAITO Yuji,, YANAGI Hiroyuki, MITSUYA Yuko

<In FY2024>

Chairperson: KOBAYASHI Eizo(Lead Independent Outside Director)

Board Member ,TOTTORI Mitsuko, SAITO Yuji,, YANAGI Hiroyuki, MITSUYA Yuko

Number of meetings:5 meetings attended by all the members

Main activities:The Committee discussed specific indicators and evaluation methods for the officer remuneration system to more vigorously promote the Medium Term Management Plan, and reported back to the Board of Directors.

(4)Personnel Committee

The Company discusses matters to be consulted by the Board of Directors regarding the appointment and dismissal of executive officers and reports the results to the Board of Directors. The Personnel Committee is comprised of the President and no more than four Directors elected by a resolution by the Board, the majority of members being Outside Directors. The President serves as Chair.

<In FY2025>

Chairperson: TOTTORI Mitsuko(Representative Director, President)

Board Member: SAITO Yuji, YANAGI Hiroyuki, MITSUYA Yuko,KOMODA Masanobu

<In FY2024>

Chairperson: TOTTORI Mitsuko(Representative Director, President)

Board Member: SAITO Yuji, KOBAYASHI Eizo, YANAGI Hiroyuki, MITSUYA Yuko

Number of meetings:3 meetings attended by all the members

Main activities: In addition to matters to be reported to the Board of Directors, the Committee discussed nurturing candidates as Executive Officers and the new Executive Officer structure.

(5)Officers Disciplinary Committee

When taking disciplinary action against Directors and Executive Officers, the Officers Disciplinary Committee makes decisions. The Officers Disciplinary Committee is comprised of the President and no more than four Directors elected by a resolution by the Board, the majority of members being Outside Directors. The Chair is elected from among Outside Directors. Any submission of proposals to the general meeting of shareholders concerning the dismissal of a Director requires the approval of the Board of Directors.

<In FY2025>

Chairperson: YANAGI Hiroyuki (Outside Director)

Board Member:TOTTORI Mitsuko, SAITO Yuji, MITSUYA Yuko,KOMODA Masanobu

<In FY2024>

Chairperson: YANAGI Hiroyuki (Outside Director)

Board Member:TOTTORI Mitsuko, SAITO Yuji, KOBAYASHI Eizo, MITSUYA Yuko

Number of meetings:4

Main activities:Discussed the disciplinary actions of officers related to the Administrative Warning and Business Improvement Advisory notified by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT).

In addition to the above voluntary committees, the Lead Independent Outside Director organized a few Independent Outside Audit and Supervisory Board Member Opinion Exchange Meetings, comprising only Outside Directors and Outside Audit and Supervisory Board Members, to strengthen the network between Outside Directors.

4.Audit and Supervisory Board and Its Members

(1)Audit and Supervisory Board

The Audit and Supervisory Board makes objective and appropriate decisions from an independent standpoint, based on their responsibility to our shareholders, in fulfilling their role and responsibility pertaining to their duties, namely, audit of business execution, nomination and dismissal of accounting auditors, and exercise of rights concerning auditor remuneration.

<In FY2025>

Chairperson : KIKUYAMA Hideki(Audit and Supervisory Board Member)

Members : KIKUYAMA Hideki, TAMURA Ryo, KUBO Shinsuke, OKADA Joji, and MATSUMURA Mariko

<In FY2024>

Chairperson : KITADA Yuichi(Audit and Supervisory Board Member)

Members: KITADA Yuichi, KIKUYAMA Hideki, KUBO Shinsuke, OKADA Joji, and MATSUMURA Mariko

Number of meetings: 15 meetings (Audit and Supervisory Board Members KITADA, KIKUYAMA, KUBO, and OKADA attended all of the 15 meetings; Audit and Supervisory Board Member MATSUMURA who have been in office since June 2024, attended all of the 11 meetings. Supervisory Board Member KAMO, who have retired in June 2024, attended all of the 4 meetings.)

Main activities:Made recommendations for the expansion of strategic discussions at the Board of Directors meetings, including the delegation of authority to the Executive Committee. In the Board Effectiveness Assessment, recommendations were made regarding the assessment for FY2024 and key issues for FY2025.

(2)Audit and Supervisory Board Members

〔Audits〕

①Audit and Supervisory Board Members attend Board meetings and other important meetings, and audit important management matters, business operations and business execution by exchanging opinions with Representative Directors and Outside Directors, and inspecting important agenda items and resolutions to be passed.

②They also audit business sites and subsidiaries each year together with the Corporate Auditors Office, report back to Representative Directors and provide feedback to executing departments.

③Further, they work closely with the internal Audit Department and accounting auditors, meet regularly with full time auditors of major subsidiaries, and strive to improve and strengthen Group auditing.

〔Candidate of Audit and Supervisory Board Members〕

①Audit and Supervisory Board Members are nominated from among persons with extensive knowledge and experience in various fields to conduct audits from a neutral and objective perspective and ensure sound management.

②Any person who does not qualify as highly independent within the definition of Standards for Independence of Outside Audit established by the Company shall not be nominated for Outside Audit and Supervisory Board Member.

〔Independent External Audit & Supervisory Board Members and Ratio of Female Audit & Supervisory Board Members(as of June 24, 2025)〕

- Ratio of female Audit & Supervisory Board members:22%(1 out of 5 Auditors is a female Audit & Supervisory Board members)

〔Average Term of Office of Audit & Supervisory Board Members(as of June 24, 2025)〕

- 3 years

5.Skills Matrix

With regard to the specialized knowledge and experience that the Company’s Directors and Audit and Supervisory Board Members should possess, the necessary skill set includes the basic corporate management skills of Management Experience, Finance & Accounting, Legal/Risk Management, Personnel Affairs/Talent Development, as well as Safety Management, which is particularly important given the business characteristics of the Company, and also Global Experience, CX/Marketing, DX/IT/Technology, and GX/Environment.

6.Standards for Independence of External Directors

We have established the following standards to determine if an External Director qualifies as independent in order to establish a corporate governance system that results in high management transparency and strong management monitoring and to enhance corporate value. (Basically, persons who are not described as follows qualify as independent.)

①A person who executes or has executed business in the Company or a consolidated subsidiary in the past 10 years

②A person who is described by any of the items a - f in the past three years.

a. a business counterpart or a person executing business of such business counterpart, whose transactions with the Company for one business year exceeded 1% of consolidated revenue of the Company or the business counterpart

b. a major shareholder of the Company or a person executing business of such shareholder holding an equity ratio of 5% or more in the Company

c. a major lender for the Company or a person executing business of such lender.

d. a person who receives over JPY 10 million in donations annually from the Company or a person belonging to an entity receiving such donations

e. a person receiving remuneration of over 10 million yen excluding director remuneration from the Company or a person belonging to an organization receiving remuneration exceeding 1% of consolidated revenue of the Company

f. a person executing business of another company, where a person executing business of the Company is appointed as External Director

③The spouse or relative within the second degree of kinship of an individual described in 1 and 2.

(Note) A person executing business refers to an executive director or executive officer

7.Succession plan for President and other leaders

①The qualifications required of the President and other leaders are as follows: “Persons with qualities to steadily achieve positive results toward realizing the Corporate Policy by working together with all employees based on a firm commitment to flight safety, which is the basic foundation of business continuity for the JAL Group. They must also display initiative in practicing the JAL Philosophy. The Nominating Committee continuously discusses possible candidates for President and other executives. By providing candidates with practical and diverse experiences, such as management in a Group company and overseas assignments and activities in external organizations, they acquire the necessary grounding for management at an early stage.

②To develop the next generation of executives including Executive Officers, the Personnel Committee discusses career path mapping, cross-functional rotation, external networking and human resource pooling to promote diversity and expand their capacity and perspectives.

8.Support for Directors and Audit and Supervisory Board Members

①Legal considerations are explained to Directors, as necessary, to ensure that they are fully aware of their duties, including the fiduciary duties of the duty of loyalty and the duty of care. They are provided opportunities for continuous participation in external training and affiliated organizations.

②In addition to the provision of corporate information, Audit and Supervisory Board Members are given opportunities to participate in external training and external organizations.

③Outside Directors and Outside Audit and Supervisory Board Members receive advance explanations on Board agendas, corporate information and other requests, as appropriate. In order to deepen the understanding of the Company, Directors and Audit and Supervisory Board Members receive explanations on safety matters through visits to frontlines, a climb up Mt. Osutaka, a tour of the Safety Promotion Center, and explanations on company history and the JAL Philosophy.

9.Evaluation of the Effectiveness of Board of Directors Meetings

Under the Fundamental Policies of Corporate Governance, the JAL Group annually assesses the board effectiveness and appropriately reviews the operation of the Board of Directors, taking into account the assessment of each Director and Audit and Supervisory Board Member.

(1)Process of the FY2024 Effectiveness Assessment

①All Directors and Audit and Supervisory Board Members were scrutinized by answering a questionnaire and interviewed by the Board of Directors Secretariat, and based on the results of the analysis, the Board of Directors discussed the evaluation and future initiatives.

The questionnaire consists of a five-point rating scale and open-ended questions regarding Board composition, supervision, management strategy, dialogue with shareholders, Board culture, contributions of Outside Directors, Audit and Supervisory Board Member activities, and Board operations.

②Subsequently, the Corporate Governance Committee (*), whose main members are independent Outside Directors, compiled recommendations, and the Board of Directors decided on future initiatives as described below.

The third-party analysis is conducted every three years. The most recent analysis was during the effectiveness assessment in FY2023.

(*) Attended also by Outside Audit and Supervisory Board Members.

(2)FY2024 Evaluation Results

Through the above process, we have confirmed that the Board Effectiveness has been ensured and recognized the issues that need to be addressed.

①Outline

Through the questionnaire and interviews, we have outlined each of these elements as follows.

〔Board composition〕

Ensured the skills and diversity of the Board of Directors and Audit and Supervisory Board Members.

〔Supervision〕

Supervision was conducted in terms of risk management, delegation of authority to the President, monitoring of execution, and disclosure.

〔Management strategy〕

While the immediate strategic issues have been addressed as described below, further discussion on midium- to long-term growth strategies is desirable.

〔Dialogue with shareholders〕

Received periodic reports and provided advice on the status of dialogue and other initiatives with institutional investors.

〔Board culture〕

Free, vigorous, and constructive discussions and exchanges of opinions are held.

〔Contributions of Outside Directors〕

Outside Directors are aware of their responsibilities and play an appropriate role in supporting both risk-taking and exercising a restraining function, while building a good relationship with the executive officers.

〔Audit and Supervisory Board Member activities〕

Audit and Supervisory Board Members report their activities to the Board of Directors in an appropriate manner and express their opinions, thereby exercising their inspection function.

〔Board perations〕

The Board operates appropriately in terms of agenda selection, support for Outside Directors, and the like.

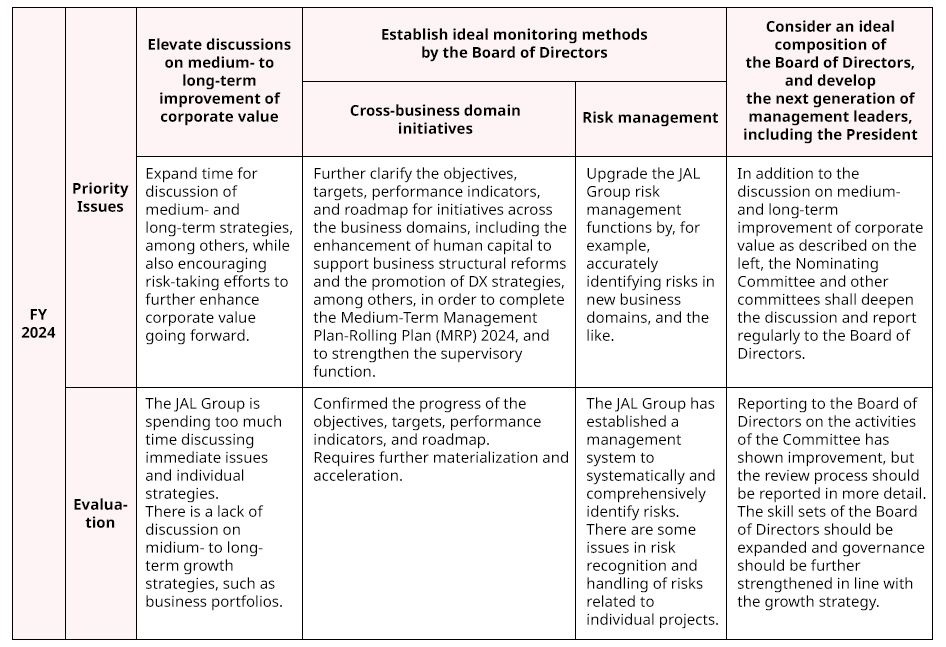

②Evaluation of Priority Issues for FY2024

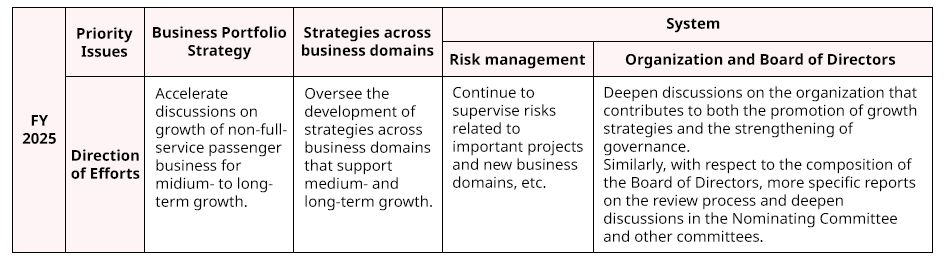

(3)Priority Issues for FY2025

Based on the above evaluation for FY2024, we have set the following priority issues to be addressed in order to formulate a medium- to long-term growth strategy, since FY2025 is the final year of the current Medium Term Management Plan and we are required to formulate a strategy for further growth in FY2026 and beyond.

We will continue to improve the effectiveness of the Board of Directors through various initiatives, such as strengthening communication between Outside Directors and the executive officers.

10.Remuneration of Directors

(1)Basic policy

①To support the sustainable and steady growth of the Company and the JAL Group and to increase corporate value over the medium and long term, the Company will encourage the performance of duties consistent with its Corporate Policy and management strategies and provide strong incentives for the achievement of specific management targets.

②The Company will establish appropriate proportions for performance-linked bonus linked to fiscal yearperformance and, for the purpose of further promoting the aligning of interests with shareholders, aperformance-linked share-based remuneration linked to corporate value in accordance with medium tolong-term performance, in order to contribute to the demonstration of sound entrepreneurial spirit.

③The Company will reward the management team appropriately based on the Company’s business performance.

(2)Remuneration levels and composition

①The Company will set appropriate remuneration levels based on the Company’s operating environment and with reference to objective data on remuneration in the marketplace.

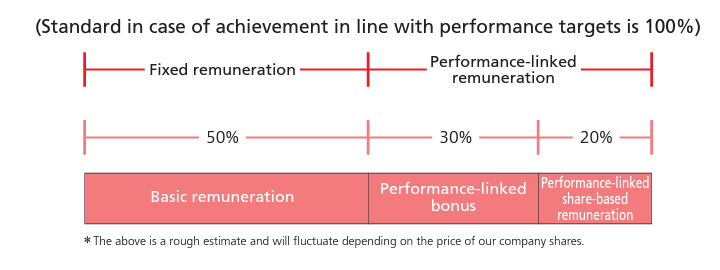

②Considering factors including the nature of the Company’s business and the effectiveness of performance-linked remuneration, fixed remuneration and performance-linked remuneration are comprised as follows. (Assuming 100% achievement against targets)

(Assuming 100% achievement against targets)

・Amount of fixed basic remuneration※:50%

・Amount of performance-linked bonuses to be paid according to the degree of achievement against targets: 30%

・Amount of performance-linked share-based remuneration to be issued according to the degree of achievement against targets: 20%

The above ratio is for guidance only and adjustments can be made to reflect changes in the price of the Company’s shares or other factors.

※ This amount excludes allowances in cases where an Executive Officer serves concurrently as a Director or where an Executive Officer has representative authority.

Note:Remuneration paid to Outside Directors is solely fixed basic remuneration.

(3)Framework for performance-linked remuneration

The performance-linked bonus and the performance-linked share-based remuneration will be reviewed asnecessary in accordance with changes in the business conditions, the roles of officers, etc. In order to strongly

advance our finance strategy, business strategy and ESG strategy, the three pillars of our management strategyunder the Medium-term Management Plan, we have revised the performance evaluation indices for the

performance-linked bonus and the performance-linked share-based remuneration and other factors for

FY2022 and beyond.

There is no provision of performance-linked share-based remuneration for the period which started in FY2021in light of our performance and other factors.

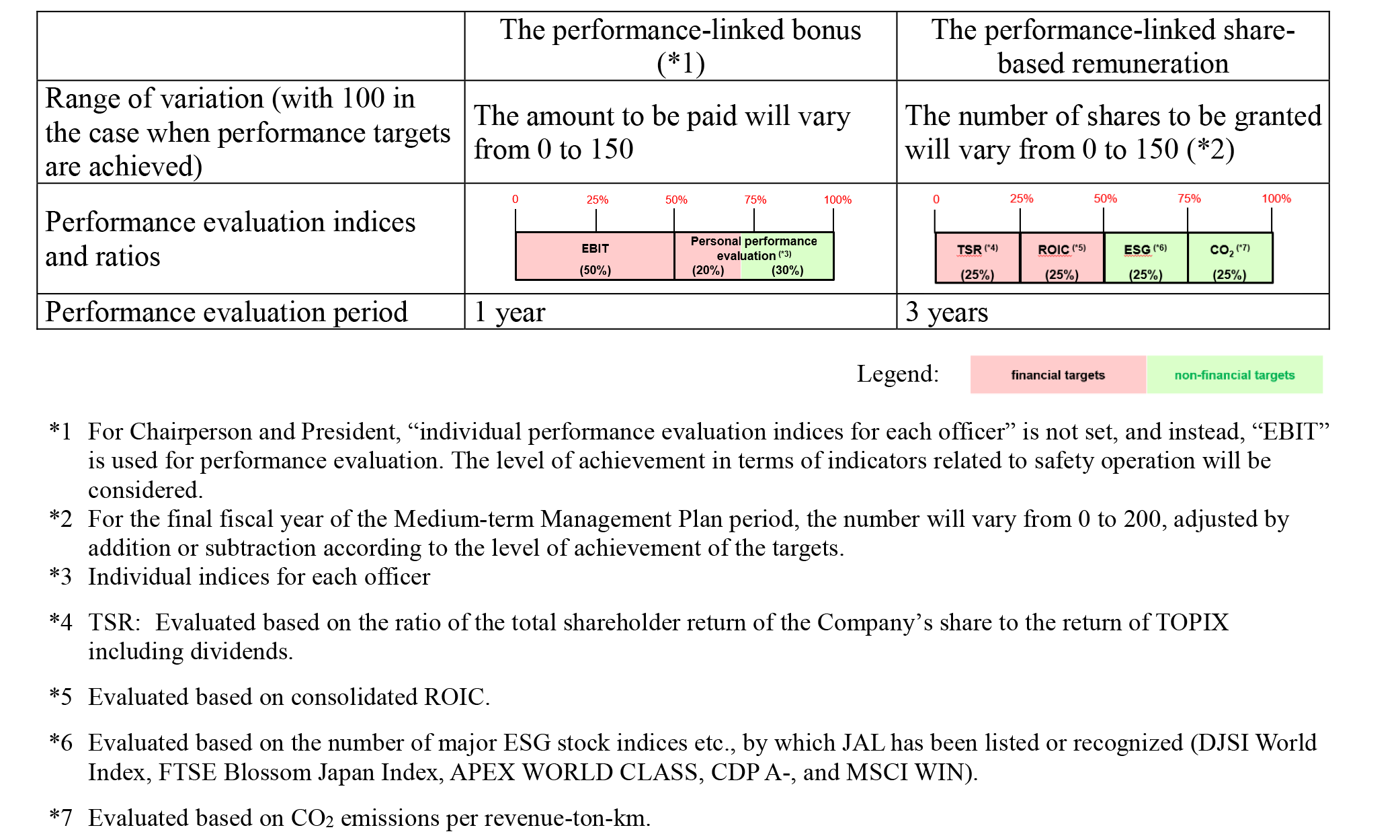

①Annual incentives (performance-linked bonuses)

The amount to be paid every fiscal year as an annual incentive will vary from 0 to 150 depending on the degree of achievement, with 100 representing the amount to be paid when achievement is in line with performance targets.

■Performance Indicators

・EBIT

・Individual performance indicators for each officer

・Taking into consideration the achievement level of safety targets

Evaluation indices will be considered for review as necessary in accordance with changes in business conditions, the roles of each officer and other factors.

②Long-term incentives (performance-linked share-based remuneration)

The number of shares to be granted every fiscal year as a long-term incentive will vary from 0 to 150 depending on the degree of achievement, with 100 representing the number to be granted when achievement is in line with performance targets. The performance evaluation period will be three years, with performance for three consecutive fiscal years evaluated every year.

■Performance Indicators

・TSR(ratio to TOPIX including dividends) consolidated ROIC

・The number of ESG stocks selected

・Carbon emissions per revenue ton kilometers

・Customer satisfaction, etc.

With respect to common stock granted to eligible Directors and Executive Officers through the share-based remuneration plan, the Company will establish a target number of held shares for each position and impose limits on share sales to further promote the aligning of interests with shareholders.Executive officers cannot sell their shares until performance-linked share-based remuneration has been issued to the amount equivalent to three years' worth (based upon when 100% of performance targets are achieved).

(4)Procedures for determining remuneration

Matters related to remuneration of Directors will be decided by the Board of Directors, following deliberation and reporting within a Compensation Committee arbitrarily established by the Company. A majority of the members of the Compensation Committee will be Outside Directors, and its Chairman will be appointed from among the Outside Directors. Basic remuneration is to be paid monthly and performance-linked bonuses and performance-linked sharebased remuneration is to be paid annually.

(5)FY2024 Actual Remuneration Paid to Directors and Audit & Supervisory Board members

※1 Annual incentives (performance-linked bonuses)

※2 Long-term incentives (performance-linked remuneration)

The ratio of the amount of shares held by Director Executive Officers to Basic remuneration (including shares acquired in Employee Stock Ownership Plan, etc.) is 22.22% for Representative Director, President and 10.86% for other Directors Executive Officers.

11.Internal Controls System

-

Development of the Internal Controls System (Fundamental Policies)

-

Operation of the Internal Controls System

12.Internal Audits

In accordance with the annual audit plan established by the Audit Department based on the results of the risk analysis, we conduct audits focusing on risks that may hinder the achievement of JAL Vision 2030, such as the risk of serious losses, the effectiveness and efficiency of operations, the reliability of financial reporting, compliance with laws and regulations, and asset preservation. As for the reliability of financial reporting, we evaluate the internal control reporting system for financial reporting under the Financial Instruments and Exchange Act as an independent organization under the direct control of the President.

From the perspective of auditing, the Audit Department, as the third defense line in the Three Lines of Defense model, places emphasis on checking the second defense line, such as the General Affairs Department, Risk Management Department, Legal Affairs Department, IT Planning and Management Department, and Accounting Department, utilizing the expertise, to verify whether they are supporting and monitoring Group organizations properly. In addition, internal audits are conducted annually on the risk management process for the Risk Management Department.

Results of internal audits are reported to the President at each instance and information on important matters concerning internal controls is provided to the Audit & Supervisory Board Members and Accounting Auditor to promote mutual coordination. The Board of Directors is regularly informed of the results of audits.

The Corporate Safety and Security Division, Engineering and Maintenance Division, and Audit Department are responsible for safety audits and maintenance audits which are conducted in compliance with laws and regulations on the air transport business.

13.Accounting Audits

KPMG AZSA LLC conducts accounting audits in accordance with the Companies Act and the Financial Instruments and Exchange Act.

In addition to periodic audits, accounting issues such as the establishment, amendment and abolition of laws, regulations and rules are checked as necessary to achieve appropriate accounting work.

Relationship with Shareholders

1.Policy on Constructive Dialogue with Shareholders

We are aware that the general meeting of shareholders is a venue for constructive dialogue with shareholders, and secure and provide a period for them to sufficiently examine accurate information from their standpoint through the Convocation Notice of the General Shareholders' Meeting, etc. We provide easy-to-understand information at the general meeting of shareholders and have developed an environment in which shareholders can exercise their rights appropriately.

Furthermore, we conduct IR (Inventor Relations) activities to maintain positive interactive communication under the following policy, in which Representative Directors, the Finance and Accounting Director, etc. engage in active dialogue, and fairness, accuracy and continuity of management strategies, business strategies, financial information, and such are emphasized.

①The Chief Financial Officer of the JAL Group, the Finance and Accounting Director, and the General Affairs Director are assigned as management to oversee dialogue with shareholders.

②We assign a supervisor to oversee information gathering, management and disclosure, and also staff to implement these duties in the Finance Department, and disclose information in a timely, fair and appropriate manner in coordination with related departments.

③We hold meetings to explain our financial results and management plan when announcing them, issue an integrated report, “JAL Report,” etc., hold meetings for shareholders to explain other matters , and arrange tours of facilities, etc. to promote investment opportunities and improve information disclosure.

④We feedback results of dialogue with shareholders to management, as necessary, so that management may share the shareholders’ requests and opinions and an awareness of issues, and reflect their views in corporate management.

⑤We establish and disclose a “silent period,” during which we do not provide any replies or comments to inquiries or information on corporate status to prevent information leaks and ensure fairness. We conduct information management and control insider information.

2.Social Responsibilities as a Corporate Citizen

JAL Group has established the Basic CSR Policy "The JAL Group will strive to meet the expectations of society, address social issues, and pass on a better society to future generations through its core air transport business as the 'Wings of Japan'." We aim to realize our Corporate Policy by collaborating with shareholders and practicing JAL Philosophy.

In order to view PDF documents, you will need to have the free Adobe ReaderOpen link in a new window software installed on your computer.