Business Risks

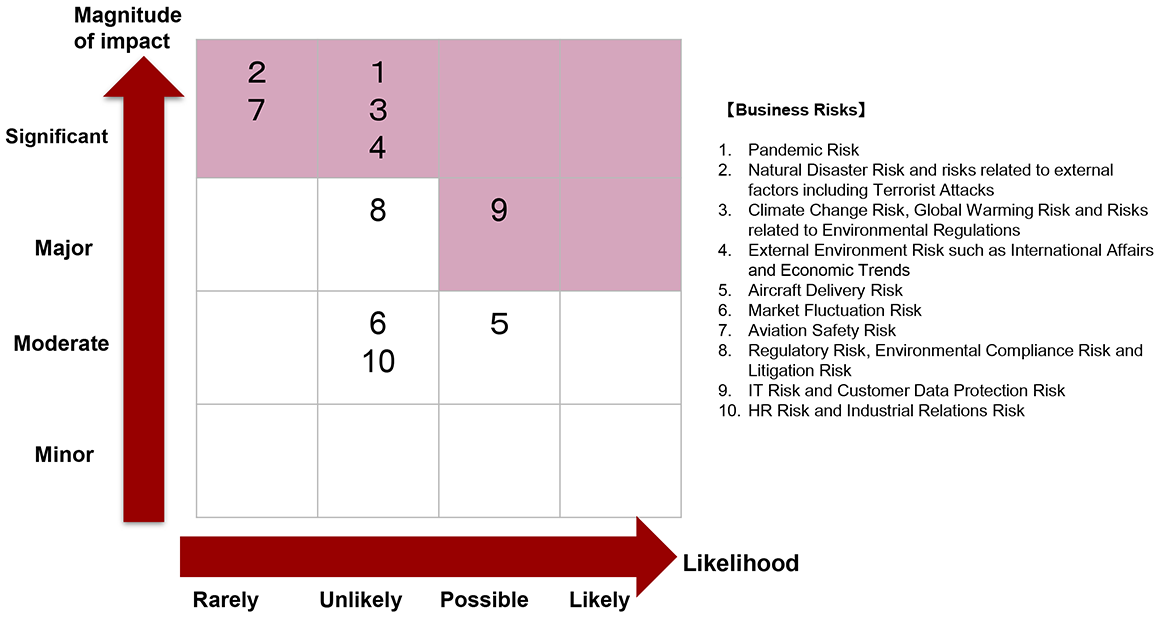

The JAL Group conducts risk assessments biannually and updates its list of risks and risk map. We are taking steps to identify and prioritize our risks and act on them (by how we have prioritized them).

The JAL Group has identified several risks that could have a material impact on investment decisions. The list is not exhaustive, and the JAL Group may be affected by unforeseen risks not described below. This report also contains forward-looking statements based on information available to the Company as of March 31, 2025. The JAL Group is exposed to the following principal risks due to the nature of its business activities, centered on the air transportation business.

Please note that the “likelihood of occurrence” and “magnitude of impact” mentioned in Business risks (1) to (10) below refer to the risk exposure after implementing risk response measures.

(1) Aviation Safety Risk

Likelihood of occurrence : Rarely , Magnitude of impact : Significant

The JAL Group implements a wide range of measures on a daily basis to ensure the safe operation of its flights. However, a single fatal accident has the potential of undermining customer trust in flight safety of the JAL Group and lead to a loss of public support. We must also provide compensation for any passenger fatalities or injuries in the event of an accident, which could have a severe impact on our operating performance. In addition, safety issues related to the JAL Group, the same aircraft type operated by the Group or codeshare flights could undermine customer trust in JAL Group’s flight safety and lead to a loss of public support, which could affect our operating performance.

The JAL Group positions safety as the basic foundation of business continuity and all employees make unwavering efforts each day to ensure flight safety. We have a department dedicated to dealing with aircraft accidents and have established the Group Safety Enhancement Council chaired to the President to manage safety of the entire JAL Group. To reduce damage and to pay compensation to victims of an aircraft accident, we have purchased liability insurance equal to current industry standards in terms of amount and coverage.

(2) Pandemic Risk

Likelihood of occurrence : Unlikely , Magnitude of impact : Significant

①Risks related to short-term impact on business performance

The JAL Group operates the air transportation business in Japan and around the world. A global outbreak of an unknown disease such as COVID-19, which has been spreading around the world since the beginning of 2020, could bring about a sharp drop in air passenger demand due to restrictions on the movement of people to prevent infection, such as government-imposed travel restrictions and voluntary restraint from going out, and voluntary restraint from using aircraft by companies and passengers. As the Group’s air transportation business has a high proportion of fixed costs such as aircraft costs and personnel costs, a short-term sharp decline in demand could seriously affect the performance of air transport operators including the JAL Group.

On the wide spread outbreak of COVID-19, we worked to minimize its impact on consolidated financial results by making agile capacity adjustments to meet the sharp decline in demand, reducing fixed costs through strong cost management, seconding and transferring surplus employees to support departments in charge of vaccinations, companies outside the Group and local governments, and improving cleanliness through non-face-to-face and touchless services, cleaning and disinfection of airports and passenger cabins so as to provide our customers with peace of mind when using our aircraft.

②Risk related to medium- to long-term changes in the business environment

Due to temporary restrictions on the movement of people caused by the spread of COVID-19, IT-driven remote work has proliferated in society. As a result of these changes in social and behavioral patterns, changes in business air travel demand may affect the business strategy of our air transport business.

We are restructuring our business to enhance the LCC and Mileage and Lifestyle businesses and dispersing business risks. Additionally, by owning freighter aircraft in addition to passenger aircraft, we have established the system that allows us to actively meet cargo demand even in situations where passenger demand decreases due to the global spread of epidemics.

(3) Natural Disaster Risk and risks related to external factors including Terrorist Attacks

Likelihood of occurrence : Rarely , Magnitude of impact : Significant

The majority of JAL Group passengers use aircraft departing from or arriving at Haneda and Narita airports. Consequently, these airports play a vital role in our air transportation business. In addition, our Information System Center, which plays a key role in managing JAL Group flights, reservations and other services, and the Integrated Operations Control (IOC), which controls the global operation and scheduling of our fleet, are both located in the Tokyo area. Consequently, a major earthquake, volcanic eruption, or major typhoon in the Tokyo area could lead to the protracted closure of Haneda or Narita airports, while a fire, terrorist attack or other incident at these key facilities could lead to a prolonged outage of the Group’s information systems and operational capabilities, which would have a severe impact on the Group’s operations.

To mitigate the risk of a shutdown of the Integrated Operations Control in Tokyo, some of its functions have been transferred to the Operations Control Center at Osaka International Airport which is in 24-7 operation. but it is not a substitute for all the functions of the IOC in Tokyo. In case all functions of the Tokyo IOC stop, it will provisionally substitute until Tokyo IOC resumes operations.

(4) Climate Change Risk, Global Warming Risk and Risks related to Environmental Regulations

Likelihood of occurrence : Unlikely , Magnitude of impact : Significant

Climate change caused by global warming has become a major global issue, and if large-scale natural disasters caused by global warming were to occur in Japan more frequently, it may affect our business performance. The aviation industry consumes large amounts of fossil fuels, which cause climate change; therefore, CO2 emission reduction is a social responsibility and an extremely important management issue for the JAL Group. While companies’ social responsibility is getting greater in relation to the global environment, including global warming prevention, environmental regulations regarding CO2 emissions, noise, hazardous substances, etc. are strengthened, and it also affects consumer behavior. In the future, if environmental regulations that involve costs, such as fees for greenhouse gas emissions or introduction of greenhouse gas emissions trading scheme, are further strengthened; or if consumer behavior changes, all of which may affect our business performance. Moreover, if our efforts to reduce environmental impact are insufficient, it may undermine the company's reputation in society and affect our business operations.

Therefore, in the FY2021-2025 JAL Group Medium Term Management Plan-Rolling Plan 2025 announced in March 2025, we have positioned the ESG strategy as the top of our management strategies for realizing the value creation and growth, and will accelerate efforts to solve social issues. The JAL Group aims to achieve net-zero CO2 emissions by 2050, and to achieve this, we will promote the upgrades to fuel-efficient aircraft, adopt innovative operational techniques, and procuring SAF (Sustainable Aviation Fuel) at stable and reasonable prices, as well as applying new technologies such as emissions trading and negative emissions (CO2 removal and capture).

In addition, we have disclosed on our website the details of risks related to the climate change and our company’s responses to reduce those risks through TCFD (Task Force on Climate-related Financial Disclosures) framework.

(5) External Environment Risk such as International Affairs and Economic Trends

Likelihood of occurrence : Unlikely , Magnitude of impact : Significant

①External Environment Risk

The JAL Group’s air transportation business operates in Japan and markets worldwide. Air travel demand may be affected by global economy trends, terrorist attacks, regional conflicts, war and other events. In addition, the JAL Group’s services are partly dependent on maintenance companies, airport personnel, sky marshals, fuel suppliers, baggage handling companies, security companies, and other third parties, which could affect our business operations.

②Competitive Risk

The JAL Group faces severe competition in Japan and overseas in areas such as routes, services, and pricing. On domestic routes, we compete with other major Japanese airlines, new low cost airlines, and super express train services. On international routes, we compete with major domestic and international airlines, with competition intensifying on both domestic and international routes, alliances, codeshare agreements, and reciprocal air frequent flyer programs between overseas and Japanese airlines are contributing to the challenging environment.

Significant deterioration in this competitive climate and business environment could affect JAL Group’s operations.

The JAL Group has partnerships with global partner airlines in various forms such as joint business, alliance, codeshare, frequent flyer program, and so forth. In the non-aviation business such as the mileage business, we are working to strengthen our customer base by forging extensive partnership relationships with other industries, The JAL Group’s alliance strategy may be affected by changes in operating conditions at other partner airlines including oneworld members or joint business partners, and by changes in the oneworld alliance membership or major developments in the Group’s alliance relationships.

To reduce these risks, we will develop a system to monitor geopolitical risks, build good relationships with the relevant authorities and business partners, strengthen our product and service competitiveness, flexibly match demand and capacity, and manage contractors appropriately.

(6) Aircraft Delivery Risk

Likelihood of occurrence : Possible , Magnitude of impact : Moderate

In the air transportation business, the JAL Group places orders for aircraft with the Boeing Company, Airbus SAS and others to increase efficiency by upgrading to fuel-efficient aircraft and reducing aircraft types in the fleet. However, the delivery of new aircraft may be delayed due to technical, financial, and other reasons at aircraft manufacturers, which could force adjustments to fleet plans that may affect JAL Group’s operations over the medium and long term.

The JAL Group will constantly check status with aircraft manufacturers and review the introduction and retirement plan of aircraft as circumstances demand to reduce risks.

(7) Market Fluctuation Risk

Likelihood of occurrence : Unlikely , Magnitude of impact : Moderate

①Market Fluctuation Risk

Fluctuations in fuel prices have a significant impact on JAL Group’s business performance. We charge a fuel surcharge to partly cover the impact of higher fuel prices, but fuel price fluctuations are not immediately reflected in the fuel surcharge and it is inappropriate to ask customers to cover the entire increase in fuel prices. We also use crude oil hedging transactions to mitigate the risk of fuel price volatility. However, a drop in oil prices may not contribute to an improvement in our operating performance, as the benefits of the decline would not be reflected in business results immediately due to hedge contract positions and other factors.

②Exchange Rate Fluctuation Risk

The JAL Group operates in countries other than Japan, and some of the revenues and expenses are denominated in foreign currencies. In particular, aviation fuel prices, one of our main expenses, is largely linked to the US dollar. US dollar exchange rate fluctuations, therefore, have a greater impact on our expenses than on its revenues. To mitigate the impact of exchange rate volatility on profits, the JAL Group uses foreign currency revenues to offset foreign currency expenses and foreign currency hedging transactions. The price of new aircraft is also closely linked to the US dollar, which means we are also exposed to the risk of exchange rate fluctuations when recording the value of assets and depreciation costs related to aircraft. To mitigate this risk, we use hedging transactions to diversify opportunities for foreign currency exchange.

③Capital Market Risk and Financial Market Risk

The JAL Group needs to make significant capital expenditures such as the procurement of new aircraft. To finance these investments, we may take out loans from financial institutions or capital markets, and our ability to raise money and pay costs for the loans are affected by capital and financial market trends and by changes in our credit rating, which may limit our access to loans and lead to higher financing costs.

Furthermore, the JAL Group posts deferred tax assets, but if the expected amount of future taxable income should decline or if past deferred tax assets are reversed due to tax revisions or such, the Group’s financial position may be temporarily affected.

The JAL Group will plan and execute finance strategies to maintain a resilient financial structure to generate more cash flow and maintain and improve financing capabilities.

(8) Regulatory Risk, Environmental Compliance Risk and Litigation Risk

Likelihood of occurrence : Unlikely , Magnitude of impact : Major

JAL Group’s operations are subject to various international legal restrictions and national and local government laws and regulations. Revisions to these laws and regulations may result in even heightened restrictions on our operations, which could lead to a significant increase in costs.

①Regulatory Risk

The JAL Group operates flights in accordance with various rules and regulations, such as Japan’s Civil Aeronautics Act and other regulations governing airline businesses, bilateral aviation agreements and other international arrangements, Japan’s Antimonopoly Act and other similar antitrust laws overseas, and rules on taxes and public dues such as landing fees. Revisions to these rules and regulations or notifications of legally enforceable airworthiness directives could have an impact on our operating performance.

Moreover, the allocation of flight slots at Haneda Airport and other airports that are central to the Group’s air transport business could also affect our business performance.

The JAL Group requests the relevant authorities in Japan and overseas, such as the Ministry of Land, Infrastructure, Transport and Tourism, to ensure a fair and competitive environment.

②Litigation Risk

JAL Group business activities are exposed to the risk of various types of litigation, which could affect its operations and operating performance. In the event that a litigation is filed against the JAL Group, developments in the subsequent legal case may require additional costs and the booking of provisions, which could also affect our operating performance.

The JAL Group conducts education and awareness-raising activities of all officers and employees to ensure compliance in order to prevent legal violations and anti-competitive behavior that may lead to serious risks.

(9) IT Risk and Customer Data Protection Risk

Likelihood of occurrence : Possible , Magnitude of impact : Major

JAL Group operations are dependent on many IT systems, and system failures caused by flaws in computer programs, computer viruses, and other cyber-attacks may lead to the loss of critical data, as well as flight operation issues, which could affect the Group’s operations. Large-scale failures in power systems, communication networks, other infrastructure that support IT systems, and Cloud services for email communications could also result in significant disruption to our business performance. In addition, inadequate handling of personal data or data breaches caused by unauthorized access could undermine public trust in our business, systems and corporate brand and also customer and market trust, which could affect our business performance.

JAL group is dedicated to promoting the acquisition and maintenance of the international standard certification for information security (ISO27001) within the JAL group, striving to improve the overall information security quality of the organization. As part of our specific activities, we regularly conduct training on handling personal information and targeted email attack drills, aiming to enhance the awareness and literacy regarding information security and personal information protection among all employees, including those in JAL group companies.

Also, JAL Group implements anti-data breach and anti-virus measures and monitors threats 24/7 of unauthorized access and virus infection. We have built a cyber incident response system and act immediately and prevent recurrence. We have purchased insurance to cover personal data breach.

(10) HR Risk and Industrial Relations Risk

Likelihood of occurrence : Unlikely , Magnitude of impact : Moderate

JAL Group businesses are dependent on hiring human resources who possess national certificates or other legally required qualifications related to aircraft operation. However, due to the considerable amount of time required to acquire these qualifications and skills during the course of their duties, the JAL Group may not be able to hire sufficient human resources when required, which could affect our business performance.

In addition, many of our employees belong to labor unions, and a collective strike or other labor disputes could affect flight operations.

The JAL Group will strive to improve recruitment competitiveness, reduce the turnover rate and maintain good labor-management relations.

The risk map for the above-mentioned (1) to (10) business risks is as follows.