Status of Corporate Governance

JAL Group Fundamental Policies of Corporate Governance

We maintain an awareness that our corporate group is a member of society at large with the duty to fulfill our corporate social responsibility and contribute to society as we develop our business, in addition to fulfilling our financial responsibility of earning adequate profits by providing high quality products through fair competition while maintaining flight safety as the leading company of safety in the transport sector and providing the finest service to our customers.

Taking this into account, we have established JAL Philosophy in accordance with the JAL Group Corporate Policy, "JAL Group will pursue the material and intellectual growth of all our employees, deliver unparalleled service to our customers, and increase corporate value and contribute to the betterment of society." We will strive to enhance corporate value and achieve accountability by establishing a corporate governance system that results in high management transparency and strong management monitoring, while at the same time engaging in speedy and appropriate management decision making.

The Board of Directors has established corporate governance by adopting the Fundamental Policies of Corporate Governance as a key set of rules subsequent to the Companies Act, relevant laws and regulations and the Articles of Incorporation, and reviews it at least once a year.

Relationship with Shareholders

1. Ensuring shareholder rights

We conduct business for the joint benefit of the Company and shareholders, comply with provisions stipulated in the Companies Act and Civil Aeronautics Law, and give sufficient consideration to ensure that shareholders can exercise their rights smoothly. Especially, we are aware that the general meeting of shareholders is a venue for constructive dialogue with shareholders, and have developed an environment in which they can exercise their rights appropriately from their perspective.

Furthermore, we emphasize fairness, accuracy and continuity, actively engage in IR (Investor Relations) activities to maintain interactive communication, and promote constructive dialogue with shareholders.

2. Social responsibilities as a corporate citizen

JAL Group has established the Basic CSR Policy "The JAL Group will strive to meet the expectations of society, address social issues, and pass on a better society to future generations through its core air transport business as the 'Wings of Japan'." We aim to realize our Corporate Policy by collaborating with shareholders and practicing JAL Philosophy.

Board of Directors

1. Board of Directors

The Board of Directors ensures high management transparency and strong management monitoring through the election of candidates for the positions of Directors, Corporate Auditors, and Executive Officers, decides their remuneration, and makes important decisions.

In order to separate the management monitoring function and business execution function, the Board of Directors appoints a Director who does not concurrently serve as Executive Officer as Chairman, and an appropriate number of three or more Outside Directors who qualify as highly independent. Outside Directors perform the function of providing appropriate advice.

In order to carry out efficient decision-making, the Board may delegate decision-making of matters set forth in the Administrative Authority Criteria Table to the President pursuant to Regulations for Kessai and Administrate Authority approved by the Board. The Management Committee has been established for the purpose of contributing to appropriate and flexible decision-making on management issues by the Board of Directors and the President.

2. Ensuring effectiveness of the Board of Directors

The Board of Directors has established the Corporate Governance Committee, which is comprised of the Chairman of the Board and Outside Directors, to evaluate the effectiveness of the Board of Directors while referring to self-evaluations by each Director once a year, review operation, etc. of the Board appropriately, and disclose an overview of findings.

Evaluation of the Effectiveness of Board of Directors Meetings

JAL reviews their Fundamental Policies of Corporate Governance appropriately every year to assess the Effectiveness of the Board of Directors, company operations, among others, by referring to the assessment by each director.

<Assessment Process>

A questionnaire was conducted for the fourth time as follows, while using insights gained from the previous questionnaire and interviews conducted by a third-party organization.

To maintain anonymity, the Secretariat of the Board conducted the questionnaire to the Board members, which consisted of questions on board composition, operations, culture, oversight and discussion of management strategy, to name a few, and a textbox to write freely.

After the Secretariat of the Board reported the results of assessment and individual comments written in the textbox to the Board, the Board first discussed issues faced by the Board and relevant measures. Based on recommendations made by the Corporate Governance Committee, the Board held further discussions and decided initiatives to pursue.

<Assessment Results and Overall Future Measures>

JAL's Board of Directors holds free and open discussions among its members, with Internal Directors respecting the opinions of External Directors. The Board is well-balanced and includes Internal Directors representing the frontline, given the importance of flight safety. External Directors are provided accessibility to high-level information according to their requests and they fulfill their roles appropriately. On the other hand, when formulating the next Medium Term Management Plan from 2020, the Board confirmed the need to make a shift to strategic discussions in order to the present JAL’s future direction, strengthen preventive and continuing risk management to support sound growth, improve the Board’s role of monitoring and oversight, and promote constructive dialogue with shareholders, to name a few. Going forward, we will steadily implement these initiatives.

3. Directors

Legal considerations are explained to Directors to ensure that they are aware of their responsibilities including the "fiduciary duty of loyalty" and the "duty of care of a prudent manager" and opportunities are provided to Inside Directors for continuous participation in external training, affiliated organizations and such. The term of office is one year in order to confirm their accountability for each fiscal year. Furthermore, a remuneration system that provides sound incentives for sustainable growth has been introduced to Directors (excluding Outside Directors).

Outside Directors are appointed from persons with vast knowledge and experience in various fields in order to ensure diversity. Those who do not qualify as highly independent within the meaning of "Standards for Independence of Outside Directors" established by the Company are not appointed. Furthermore, one Outside Director from among Outside Directors is appointed as the Lead Independent Outside Director to improve coordination with Corporate Auditors and internal divisions.

To deepen the understanding of the Company of Outside Directors, we provide safety education such as a memorial climb up Mt. Osutaka and visits to the Safety Promotion Center, in addition to visiting frontlines. We also provide advance explanations on agenda items to be submitted for deliberation, as necessary, and opportunities to explain other matters at their request.

Corporate Auditors and Board of Corporate Auditors

1. Corporate Auditors

Corporate Auditors monitor important matters concerning corporate management, business operations and the execution of duties by reviewing important Kessai (written approval) documents, as well as participating in board meetings and other important meetings. Furthermore, Corporate Auditors, together with staff members of the Corporate Auditors Office, conduct an annual audit of each business location, subsidiary and affiliated company and report the results to the Representative Directors. Corporate Auditors also share information with internal audit departments and accounting auditors, hold regular meetings with corporate auditors of subsidiaries to improve and strengthen auditing of JAL Group.

We provide opportunities to Corporate Auditors for sufficiently understand the role and responsibilities required of them by providing corporate information, and opportunities are provided to Inside Corporate Auditors for continuous participation in external training, affiliated organizations and such. Outside Corporate Auditors are appointed from among persons with vast knowledge and experience in various fields, and those who do not qualify as highly independent within the meaning of "Standards for Independence of Outside Directors" established by the Company are not appointed. Outside Corporate Auditors ensure sound management by conducting audits from a neutral and objective standpoint, with the cooperation of internal audit departments and accounting auditors.

To deepen the understanding of the Company of Outside Corporate Auditors, we provide safety education such as a memorial climb up Mt. Osutaka and visits to the Safety Promotion Center, in addition to visiting frontlines. We also provide advance explanations on agenda items to be submitted for deliberation, as necessary, and opportunities to explain other matters at their request. arrange tours of airports, sales, maintenance, and other workplaces and provide training on safety.

2. Board of Corporate Auditors

The Board of Corporate Auditors makes appropriate judgment from an independent objective standpoint, based on their fiduciary responsibilities to the shareholders when fulfilling their role and responsibilities, such as auditing the execution of Director's duties, appointing or dismissing accounting auditors, and executing rights concerning auditor remuneration.

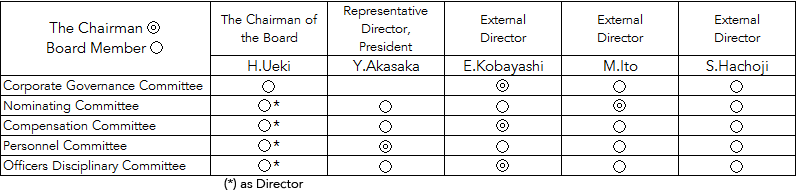

Establishment of Various Committees

We have established the following committees under the Board of Directors to build a corporate governance system that results in high management transparency and strong management monitoring.

1. Corporate Governance Committee

The Corporate Governance Committee checks, at least once a year, whether activities comply with JAL Group Fundamental Policies of Corporate Governance, conducts analyses and evaluations to determine whether such activities contribute to sustainable growth and enhancement of medium- and long-term corporate value, and provides necessary findings and reports to the Board of Directors. The Corporate Governance Committee is comprised of the Chairman of the Board and Outside Directors, and is chaired by the Lead Independent Outside Director.

2. Nominating Committee

When submitting a proposal to the general meeting of shareholders concerning the appointment of candidates to the positions of Director and Corporate Auditor, the Nominating Committee comprehensively judges the personality, knowledge, ability, experience, performance and other attributes of each candidate based on an inquiry from the Board of Directors and reports back. The Nominating Committee defines the President and other board members as persons with qualities to steadily get positive results toward realizing the Corporate Policy by working together with every staff based on a firm commitment to flight safety, which is the basis of existence of the JAL Group, and display of initiative in practicing the JAL Philosophy. The Nominating Committee assists candidates for President and other posts to quickly acquire grounding and discipline necessary for management through practical and diverse experiences.

Furthermore, in case the qualities of any member of top management is found questionable due to violation of the law, harassment, negligence of the Board of Directors or such, members of the Nominating Committee and other Directors excluding the person in question will immediately conduct investigations based on a motion made by a Director at a Board meeting or other meeting. The Nominating Committee or other Directors will report the result of investigations to the Board of Directors. Treatment of the person in questions shall be decided through a resolution by the Board.

The Nominating Committee is comprised of the President and no more than four Directors elected by a resolution by the Board of Directors, the majority of members being Outside Directors. The Chairman is elected from among Outside Directors.

Furthermore, the Committee continuously discusses various topics such as the election of successors to the President and other leaders to change and drive growth of the JAL Group in order to realize the JAL Group Corporate Policy and management strategies, and reports the result of their discussions to the Board.

3. Compensation Committee

The Compensation Committee discusses matters concerning the amount of compensation for Directors, Executive Officers and Corporate Auditors based on an inquiry from the Board of Directors and reports back.

The Compensation Committee is comprised of the President and no more than four Directors elected by a resolution by the Board, the majority of members being Outside Directors. The Chairman is elected from among Outside Directors. As a result, transparency and fairness in the compensation determining process is secured.

4. Personnel Committee

When appointing or dismissing an Executive Officer, the Board of Directors consults the Personnel Committee and takes into account the Committee's report on such matters before passing any resolution. The Personnel Committee is comprised of the President and no more than four Directors elected by a resolution by the Board, the majority of members being Outside Directors. The President serves as Chairman.

5. Officers Disciplinary Committee

When taking disciplinary action against Directors and Executive Officers, the Officers Disciplinary Committee makes decisions. The Officers Disciplinary Committee is comprised of the President and no more than four Directors elected by a resolution by the Board, the majority of members being Outside Directors. The Chairman is elected from among Outside Directors. Any submission of proposals to the general meeting of shareholders concerning the dismissal of a Director requires the approval of the Board of Directors.

In addition to the committees listed above, venues for exchange of opinions are held comprised of Independent Directors only, in order to exchange information and share views from an independent, objective standpoint.

Constitution of Each Committee

Information Disclosure

To enable our stakeholders to easily access JAL Group's corporate stance, various information such as our Fundamental Policies of Corporate Governance, Corporate Policy, management strategies, and management plan, is posted on our website. We issue "JAL Report" containing financial information and CSR activities each year.

JAL Philosophy Education

The President conducts JAL Philosophy Education for JAL Group Directors including the President, and employees in order to penetrate JAL Philosophy into JAL Group.

Policy on Constructive Dialogue with Shareholders

We are aware that the general meeting of shareholders is a venue for constructive dialogue with shareholders, and secure and provide a period for them to sufficiently examine accurate information from their standpoint through the Convocation Notice of the General Shareholders' Meeting, etc. We provide easy-to-understand information at the general meeting of shareholders and have developed an environment in which shareholders can exercise their rights appropriately.

Furthermore, we conduct IR (Inventor Relations) activities to maintain positive interactive communication under the following policy, in which Representative Directors, the Finance and Accounting Director, etc. engage in active dialogue, and fairness, accuracy and continuity of management strategies, business strategies, financial information, and such are emphasized.

- We assign the Finance and Accounting Director and General Affairs Director as management to oversee dialogue with shareholders.

- We assign a supervisor to oversee information gathering, management and disclosure, and also staff to implement these duties in the Finance Department, and disclose information in a timely, fair and appropriate manner in coordination with related departments.

- We hold meetings to explain our financial results and management plan when announcing them, issue "JAL Report" and "To Our Shareholders," and arrange tours of facilities, etc. to promote investment opportunities and improve information disclosure.

- We feedback results of dialogue with shareholders to management, as necessary, so that management may share the shareholders' requests and opinions and an awareness of issues, and reflect their views in corporate management.

- We establish and disclose a "silent period," during which we do not provide any replies or comments to inquiries or information on corporate status to prevent information leaks and ensure fairness. We conduct information management and control insider information.

Standards for Independence of Outside Directors

We have established the following standards to determine if an Outside Director qualifies as independent in order to establish a corporate governance system that results in high management transparency and strong management monitoring and to enhance corporate value. (Basically, persons who are not described as follows qualify as independent.)

- A person who executes or has executed business in the Company or a consolidated subsidiary in the past 10 years

- A person who is described by any of the items a - f in the past three years

- a business counterpart or a person executing business of such business counterpart, whose transactions with the Company for one business year exceeded 1% of consolidated revenue of the Company or the business counterpart

- a major shareholder of the Company or a person executing business of such shareholder holding an equity ratio of 5% or more in the Company

- a major lender for the Company or a person executing business of such lender

- a person who receives over JPY 10 million in donations annually from the Company or a person belonging to an entity receiving such donations

- a person receiving remuneration of over 10 million yen excluding director remuneration from the Company or a person belonging to an organization receiving remuneration exceeding 1% of consolidated revenue of the Company

- a person executing business of another company, where a person executing business of the Company is appointed as Outside Director

- The spouse or relative within the second degree of kinship of an individual described in 1 and 2.

(Note) A person executing business refers to an executive director or executive officer.

Schematic Diagram of Corporate Governance System

We have established other organizations concerning corporate governance as below.

Management Committee

The Management Committee is an organ established by the Company for the purpose of contributing to appropriate and flexible decision-making by the Board of Directors and the President. The committee will deliberate over important issues requiring a resolution of the Board of Directors and matters requiring approval by the President that need to be confirmed by the Management Committee before presenting these issues to the Board or to the President.

Group Earnings Announcement Session

The Group Earnings Announcement Session is attended by Directors, Executive Officers and presidents of major subsidiaries to share the status of Group earnings and consider ways to improve business performance.

JAL Philosophy Council

Establishes the fundamental policy, and draws up, enforces, and manages progress of measures to promote penetration of the JAL Philosophy.

Group Council for Safety Enhancement General Meeting

To rigorously promote safety, the Corporate Safety and Security Department is established directly under the President. The Group Council for Safety Enhancement General Meeting, which serves as Secretary of the Corporate Safety and Security Department, shares information safety in daily operations, decides countermeasures, considers important measures relating to safety and checks policies.

Corporate Brand Promotion Council

The Corporate Brand Promotion Council establishes important policies on corporate brand (corporate value) based on the JAL Group Corporate Policy and strategies, clarifies the status of corporate activities, manages progress of various corporate brand enhancement measures and shares information.

Management Liaison Committee

The Management Liaison Committee checks progress with matters relating to management and shares information among Directors.

In order to view PDF documents, you will need to have the free Adobe Reader別ウィンドウで開く software installed on your computer.